What’s Open on Campus

Posted on Thursday, September 16th, 2021

We’re so excited to let you know about the many on-campus services that are re-opening for the Fall Term. From our gorgeous new fitness and recreation centre to a librarian on hand to help you at the on-campus library, we’re thrilled to offer you more reasons to be on campus.

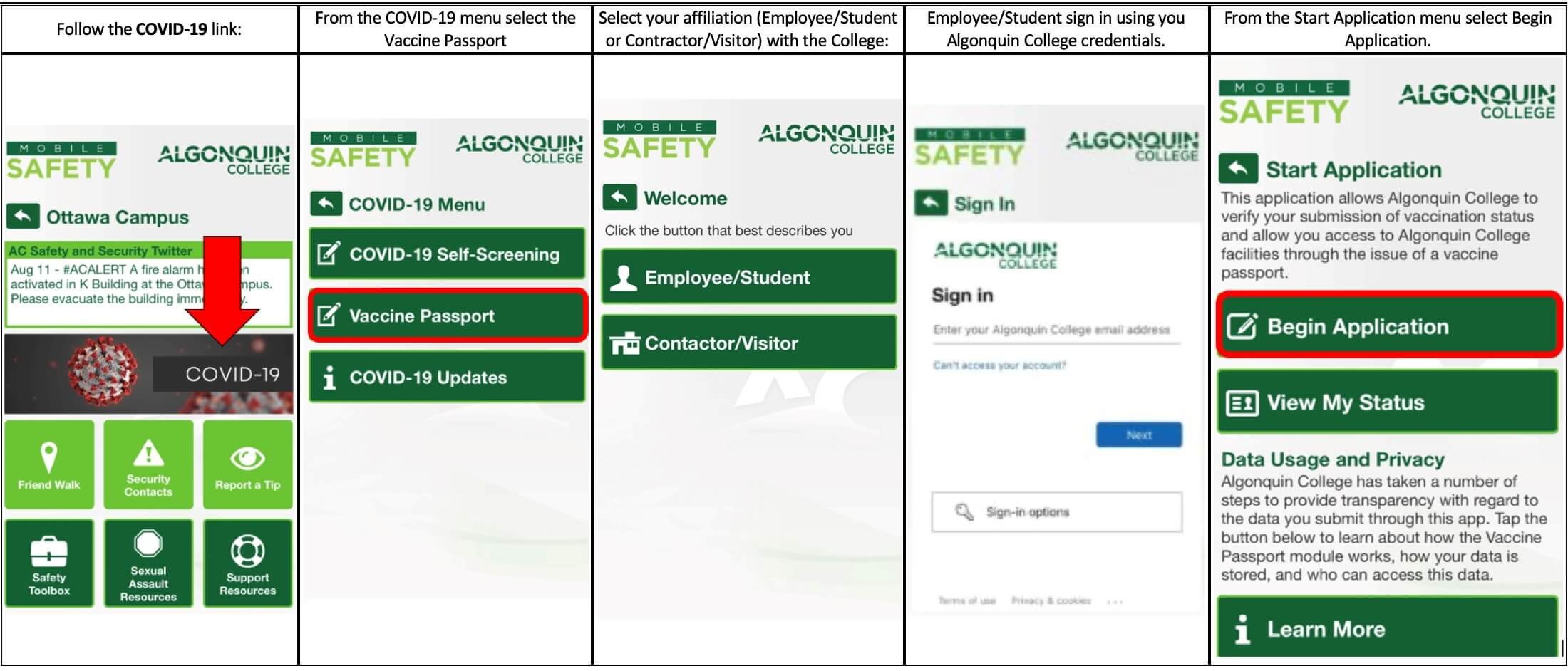

Please not that our mandatory vaccination policy, which was developed with the health and safety of all our students in mind, went into effect on September 7. For more details on what is required to visit campus, click here.

What’s Open:

- The Library: There will now be one librarian, one front desk coordinator and four library technicians on site at the library to help you with all your info and resource needs. Hours: 8:30 am to 4:45 pm. You can also still access the library online.

- Counselling Services: We have a select number of in-person appointments available each day. You can also still talk to counsellors via phone or video. To make an appointment, please call 613-727-4723 ext. 7200, between 8 am and 6 pm, or by emailing welcomecentre@algonquincollege.com. For more information on our counselling services, click here.

- Jack Doyle Athletics and Recreation Centre: The stunning new Jack Doyle Athletics Recreation Centre –ARC for short—is now open. There are so many incredibly cool features, activities and spaces this facility has to offer, including 10-pin bowling, a golf simulator, a state-of-the-art circuit training area, and a full-service restaurant. Get ready to get fit and have fun. To see the full range of amenities at ARC, click here. ARC Hours: Monday to Friday, 9 am to 6 pm.

- Connections: The Campus Store & The Print Shop: Your campus book store is now open! Grab books, that Algonquin hoodie you’ve been eyeing, or other supplies in-person, or order online for curbside pick-up, which will be available throughout the fall. Need to print something? No worries, The Print Shop located inside Connections is now open for-in person service. To order printing online, click here or email acprintshop@algonquincollege.com to arrange for curbside pick-up. Hours: Monday to Friday, 9 am to 5 pm.

- Food Cupboard: The Students Association’s Food Cupboard provides food and other basic necessities to students in need. In-person appointments are available Tuesday to Thursday, 8 am to 3 pm. Drop-in is still on pause. Curbside is still also available. For more info, click here.

- Clubs and Communities Office: To discuss starting or joining a club, you can visit the Clubs and Communities office in person on Tuesday, Wednesday and Thursday between 9 am and 4 pm, or online Monday and Friday between 9 am and 4 pm.

- Wellness and Equity Centre: The Wellness and Equity Centre is a safer space, welcoming all students of the College, no matter their sexual orientation, gender identity, race, disability status, or any other factors, and focuses on student well-being. They are now open for select in-person services, and will continue to operate online. Click here for more information.

Food, Food, Food! We’ve got so many awesome places to dine on campus, from delicious coffee and pastries to Grab n Go items to full, hot sit-down meals. Most of our dining options on campus are now open for the Fall 2021 term. All you need to do is choose:

- Marketplace Food Court (for hot meals and Grab n Go items. See full menu here): Monday to Thursday, 7:30 am – 7 pm, Friday: 7:30 am – 6 pm.

- 35th Street Market Café (in Residence): Monday to Sunday, 9 am to 10 pm

- The Fix Eatery (ACCE Building) (for coffee, pastries & Grab n Go sandwiches, salads, etc. See menu here.): The Fix is open Monday to Friday, 7 am to 3:30 pm.

- Restaurant International: Feeling like an extra special dining experience? Check out what our culinary students are up to and dine at Restaurant International, which will start serving lunch on September 22, and dinner starting September 29. The restaurant will be open Wednesday, Thursday and Friday for lunch, and Wednesday through Saturday evenings for dinner. For more information, click here.

- Starbucks: The Starbucks inside the Student Commons is open Monday to Friday from 7 am to 4 pm. For more information, click here.

WHAT WILL REMAIN ONLINE ONLY

- The Registrar’s Office and Financial Aid: The office will continue to run virtually from 8:30 am to 4:30 pm, from Monday to Friday. Find more information here.

- Card Services: To receive an AC Card (student ID), you can complete the process online here.

- Parking Office: Parking office will continue to offer support via email and phone only at parking@algonquincollege.com or at 613-727-4723 x 7187.

- Posted in

- Academic Success Financial Aid News Student Life

- Tags: